The Union budget 2020 has introduced new income tax regime in India for Individual taxpayers with reduced rates (and increased twists).

We will discuss about the following in this article:

- What’s there in the income tax old regime and new regime?

- What are the conditions to avail it and who can opt it?

- Is it better to opt the new regime or stay with the old one?

What’s the new tax regime?

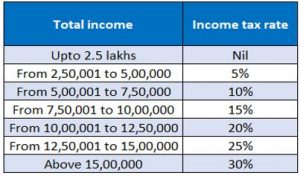

The new personal income tax regime comes up with a new income tax slab for Individuals which is produced below:

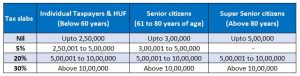

While previously we had the below income tax slabs prevalent:

So, it is pretty evident that while the old regime had different tax slabs for different age groups, new tax does not provide the varied tax slabs on basis the age groups

What are the conditions to avail the new regime and who can opt it?

- Any Individual can opt the new tax regime, meaning to say that the new regime is an optional regime and Individual taxpayers can choose between the old & new tax regime.

- Further, where the taxpayer earning income from business has opted for the new regime for any year and withdraws it in any subsequent year, cannot opt for the new regime again and has to follow the old tax slabs only. However, other Individual taxpayers can choose between the regimes every year.

- CBDT circular issued on April 13, 2020 has directed all the employers to obtain a declaration from employees, if they wish to opt for the new tax regime. However, employees will still continue to have the right to choose between the tax regimes at the time of filing the return.

- Individuals opting for the new regime has to forego certain exemptions and deductions which were available with the old regime.

Here’s a list of the main exemptions and deductions that tax payers will have to forgo if they opt for the new regime.

(i) Leave travel allowance exemption which is currently available to salaried employees twice in a block of four years

(ii) House rent allowance normally paid to salaried individuals as part of salary.

(iii) Standard deduction of Rs 50,000 currently available to salaried tax payers

(iv) Deduction available under section 80TTA/80TTB i.e. Deduction in respect of Interest on deposits in savings account) and 80TTB (Deduction in respect of Interest on deposits to senior citizens) will not be available to the taxpayers.

(v) Deduction for entertainment allowance (for government employees) and employment/professional tax as contained in section 16

(vi) Tax benefit u/s 24 on interest paid on housing loan taken for a self-occupied or vacant house property.

(vii) Deduction of Rs 15000 allowed from family pension under clause (iia) of section 57

(viii) The most commonly claimed deductions under section 80C will have to be forgone. This includes the commonly availed section 80C deductions claimed for provident fund contributions, life insurance premium, school tuition fee for children and various specified investments such as ELSS, NPS, PPF etc.

However, deduction under sub-section (2) of section 80CCD (employer contribution on account of employee in notified pension scheme—mostly NPS) and section 80JJAA (for new employment) can still be claimed

(ix) The deduction claimed for medical insurance premium under section 80D will also not be claimable

(x) Tax benefits for disability under sections 80DD and 80DDB will not be claimable

(xi) Tax break on interest paid on education loan will not be claimable-section 80E

(xii) Tax break on donations to charitable institutions available under section 80G will not be available

All deductions under chapter VIA (like section 80C, 80CCC, 80CCD, 80D, 80DD, 80DDB, 80E, 80EE, 80EEA, 80EEB, 80G, 80GG, 80GGA, 80GGC, 80IA, 80-IAB, 80-IAC, 80-IB, 80-IBA, etc. will not be claimable by those opting for the new tax regime.

Making the choice between the old regime & new regime of income tax slabs

Choosing between the tax regimes, might depend upon various factors such as current income level, income composition i.e. sources of income, investment appetite & saving habits among other factors. The individuals will have to work out their tax liability under the old and new tax regime before deciding which one is more beneficial.

Income tax department has also come up with an easy to use calculator which tells one about which regime would be beneficial on basis the outflow of tax. You can access it here: https://www.incometaxindiaefiling.gov.in/Tax_Calculator/

While deciding to choose between the old & new tax regime, one should look at the pros and cons of both the regimes in order to make a wise decision. Thus, we put down some of the important pros and cons in the below matrix:

The last word: In light of the above, in order to decide between the new income tax regime in India & the old regime, one need to make a careful analysis & comparison of tax outgo and other factors in choosing