Here, I aim to discuss the new procedures around claiming refund of GST for businesses engaged in export of goods or services. Earlier due to the unavailability of electronic fund module on common portal, a temporary mechanism was devised and implemented wherein applicants were required to file the refund of application and the supporting documents manually.

To make the process electronic, a circular was passed after which the refund application along with supporting documents shall be submitted electronically. However, the provisions of the following circular shall apply for the applications filed on the portal before 26 September 2019 and the said applications shall be processed manually.

Before we move further to explain the simplification of process, we need to understand the basic process underlying the exports with the refund perspective

There are 2 modes under which one can carry on export in India as far as GST is concerned

1. Mode 1: Export of goods on the payment of Integrated tax & then exporter can claim the refund of GST paid on such goods exported.

2. Mode 2: Export of goods or/and services under bond or Letter of Undertaking (LUT) without paying any Integrated tax & claiming the refund of unutilized input credit.

Under Mode 1: The exporter would first pay IGST and then claim refund after the goods are exported. The exporter should comply with the following before applying for the refund:

a. The shipping bill is required to be filed which would also qualify as the application for refund. However, shipping bill is valid only when the person in charge of the conveyance carrying the export goods duly files an export manifest or an export report covering the number and the date of shipping bills or bills of export.

b. The applicant needs to furnish valid GST returns in form GSTR 3/3B & GSTR 1.

c. The details as filed in the GST returns would be transmitted electronically by the GST common portal to the system designated by the Customs, and this would generate a confirmation that the goods covered by the said invoices have been exported out of India.

Upon the receipt of the information regarding the furnishing of a valid return in Form GSTR-3/Form GSTR-3B from the common portal, the system designated by the Customs shall process the claim for refund and an amount equal to the integrated tax paid in respect of each shipping bill/bill of export shall be electronically credited to the registered bank account of the applicant.

Under Mode 2: The exporters can export the goods without payment of IGST, by submitting a LUT and further they can claim the refund of unutilized input credit.

Following procedure needs to be adopted:

- An exporter, before making the export, would be required to furnish a bond or a Letter of Undertaking in FORM GST RFD-11 Bond and LUT Format to the jurisdictional Commissioner.

- The applicant needs to furnish valid GST returns in form GSTR 3/3B & GSTR 1

The details as filed in the GST returns would be transmitted electronically by the GST common portal to the system designated by the Customs, and this would generate a confirmation that the goods covered by the said invoices have been exported out of India.

The process to apply for refund

Step 1: Filling Form GST RFD-01/1A:

First step for refund is to file refund application in GST FORM – 01 or GST FORM – 1A on common portal.

Step 2: Submission of application & other required documents to the Jurisdictional officer:

The common portal shall generate Acknowledgement receipt number which would be submitted to jurisdictional proper officer along with GST RFD FORM – 01/1A along with supporting documents.

Step 3: Initial scrutiny of the documents by the proper officer:

After scrutiny of application, Deficiency Memo in GST RFD-03 or Acknowledgement in GST RFD-02 will be issued within 15 days from the date of application submitted under Step – 2.

Step 4: Grant of Provisional Refund:

Provisional refund shall be granted within 7 days of acknowledgement and shall be credited directly to the bank account of applicant of acknowledgement in GST RFD-04. Payment advice shall be issued in FORM GST RFD – 05.

Step 5: Detailed scrutiny of refund application:

Following will be scrutinized in detail by officer:

- Refund statement detail with GSTR – 1 and GSTR-6A.

- Shipping bill details shall be checked.

- Detail of IGST paid on Inputs with GSTR-3 and GSTR-3B.

- Refund applied should be less than IGST paid on Inputs.

- Any adjustment in refund amount shall be made via GST RFD-07.

Step 6: Final order of refund:

Final order is to be made in form GST RFD-06.

What has changed in the process now?

The earlier process required the refund application to be made online. Though the applicant was required to furnish the physical documents to the jurisdictional officer before he could further take the application in process. Now, this has been done away with. All the documents can be submitted electronically. This will make the refund process entirely online, easy & hassle free

Things to be kept in mind in order to make a successful refund application

- Any refund claim for a tax period may be filed after furnishing all the returns due on or before the date on which refund application is being filed.

- An undertaking should be submitted along with refund claim for if the refund wasn’t eligible, the applicant would be required to pay back the claim.

- A refund claim can be filed for a tax period or by clubbing successive tax periods. However, the refund claim cannot spread across different financial years.

- Person having a turnover of up to Rs. 1.5 Crores can apply for a refund claim on a quarterly basis & can club successive quarters. However, these should be filed chronologically.

- Applications of refund unutilized ITC have to upload a copy of GSTR-2A for the period for which the refund is claimed.

- The details of the invoices for which ITC has been claimed should be uploaded in the prescribed format as Annexure B along with the application of refund claim.

- Where the refund is claimed against ITC which aren’t populated in GSTR 2A, application should also include self-certified copies of invoices to declare the eligibility of ITC.

Provisional Refund

The proper officer shall refund ninety percent of the refundable amount of claim on a provisional basis.

Disbursal of refund

While filing the refund application, the applicant can select a bank account as given at the time of registration in Form GST REG 01.

If the applicant is not provided with the refund within 60 days of submission of application, then interest at the rate 6 percent from the date of export if 60 days is to be given to the applicant.

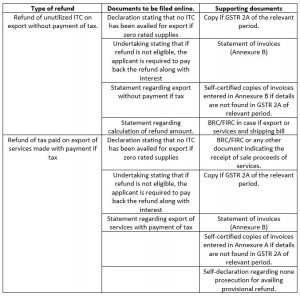

List of documents required for making the refund application