In this article I will talk in detail about What is EPF, What is UAN (Universal Account Number),Who deducts EPF, Contribution towards EPF, When can we withdraw the EPF amount, How to online transfer the EPF amount from one employer to another, How to Link Old member ID / EPF Account with UAN, Income Tax on EPF Withdrawal and Process for withdrawal of EPF.

1. What is EPF?

Employee Provident Fund is the fund the purpose of which is to provide employees with the lump sum payments at the time of exit from their place of employment. This is different from pension fund, which have elements of both lump sum as well as monthly pension payments. Employees save fraction of their salary every month under EPF scheme.

It is a very good platform for saving the portion of salary that can help employees in the event of emergency or upon retirement Every employer with over 20 employees is required by law to register with EPFO.

2. What is UAN (Universal Account Number)?

UAN has been introduced by Employees Provident Fund Organization (EPFO). UAN number is not to be confused by EPF number.

UAN number allows a member to view his or her EPF accounts with current and former employers.

With a single number, a member can initiate the process of closing old accounts and transferring balances. UAN number needs to be activated.

UAN Number and Member ID or PF Account Number these two details are mandatory for UAN activation

Following is the process for activating the UAN number:

1. Visit the EPFO website and click on “Activate UAN”, after reading all the instructions, click on “I have read and understood the instruction”.

2. Once the above steps are done, member will be asked to enter the details like, UAN number, Mobile Number, PF account number etc. and once all the details have been uploaded, click on “Get PIN”.

3. In order to complete the activation process, member needs to enter the PIN received on registered mobile number.

4. On completion of the activation, the member will be prompted to create a login user id and password for accessing the UAN services offered by the portal.

3. Who deducts EPF?

Contribution to EPF is done by both employees and employer.

Employer deducts, employees share of EPF contribution and along with his share of contribution, deposits the amount in the PF account of employees.

4. Contribution towards EPF?

The contribution paid by the employer is 12% of basic wages plus dearness allowance plus retaining allowance. An equal contribution is payable by the employee also.

Present rate of contribution towards EPF is as follows:

Employee contribute – 12 %* towards EPF.

Employer Contribute – 8.33 % * towards “Employees’ Pension Scheme”

(subject to maximum of INR 1,250 (refer note 5 for details), 3.67%* towards “Employees Provident Fund”,0.5%* towards EDLI and 0.5%* towards administrative charges.

*% is calculated of Basic Pay + Dearness Allowance + Retaining Allowance

Note:

1. Incase, an organization is covered under the EPFO and does not have a separate group insurance for its employees, the employer needs to monthly contribute 5% of the employee’s basic salary + dearness allowance + retaining allowance (capped at Rs 15000) to EDLI scheme as insurance premium.

2. Provisions of EPF covers every establishment in which 20 or more persons are employed and certain organizations are covered, subject to certain conditions and exemptions even if they employ less than 20 persons each.

3. In the case of establishments which employ less than 20 employees or meet certain other conditions, as per the EPFO rules, the contribution rate for both employee and the employer is limited to 10 percent.

4. The employee can voluntarily pay higher contribution above the statutory rate of 12 percent of basic pay. This is called contribution towards Voluntary Provident Fund (VPF) which is accounted for separately. This VPF also earns tax-free interest. However, the employer does not have to match such voluntary contribution.

5. 33% will be diverted to Employees’ Pension Scheme, but it is calculated on Rs 15,000. So, for every employee with basic pay equal to Rs 15,000 or more, the diversion is Rs 1,250 each month into EPS. If the basic pay is less than Rs 15000 then 8.33% of that full amount will go into EPS. The balance will be retained in the EPF scheme.

6. New EPF members enrolled on or after September 1, 2014, and having a basic salary of more than INR 15,000 per month at the time of joining, will not become members of the EPS. Accordingly, the entire contribution of 24% (from the employee and employer) will go to the provident fund account of the employee.

5. When can we withdraw the EPF amount?

EPF can be completely withdrawn in case if employee retires or remains unemployed for 2 months or more.

Note:

1. Its needed to mention that fact that the individual is unemployed for more than 2 months, the same has to be certified by gazetted officer.

2. Decision taken at the 222nd central board of trustees meeting of EPFO in June 2018, it was decided that subscribers of Employees Provident Fund Organization (EPFO) who resign from their service can now withdraw 75% of their total provident fund kitty after one month from the date of cessation of service to meet their monthly financial commitments.

3. One is also allowed to withdraw the EPS amount if the service period has been less than 10 years and not later on. Once this milestone is crossed, the employee compulsorily gets pension benefits after retirement.

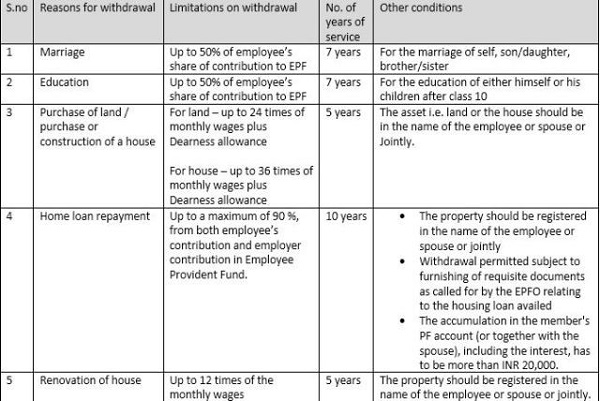

4. Following are different scenarios when and how much amount can be withdrawn from EPF

6. How to online transfer the EPF amount from one employer to another?

Steps that you must follow while applying for online EPF transfer:

Step 1: Go to the EPFO website – epfindia.gov.in

Step 2: Click on online claims member account transfer

Step 3: Enter your login details

Step 4: Go to online services tab click on “One Member – One EPF Account (Transfer Request)

Step 5: Fill in details of previous epf accounts (which are to be transferred)

Step 6: Authenticate OTP and Submit

Note:

1. For attestation you can either select “Previous Employer option” or “Current Employer option”.

2. It is preferable to select “Current Employer Option”, since communication would be hassle free.

7. How to Link Old member ID / EPF Account with UAN?

With the introduction of the UAN (Universal Account Number), it is possible to consolidate multiple accounts into one single account for each EPFO member.

Requirements to link EPF accounts with UAN number:

1. You need UAN Number

2. EPF account number to be linked with UAN Number

3. KYC Details – Bank Account Number, IFSC Code, Aadhaar number, PAN card number.

4. UAN should be activated, otherwise it would take 3 days post activation to access the services.

Process to be followed:

1. Visit EPFO Portal

2. Go to “Our Services” tab to access “for employee services”

3. Click on ‘One Employee – One EPF Account’

4. Fill required details and generate OTP, which is delivered on your registered mobile number linked with UAN

5. Provide Old EPF ID, accept the declaration and submit the request.

8. Income Tax on EPF withdrawal

Contribution towards EPF account provides employees, tax relief under section 80C (only employees share of contribution)

How-ever EPF withdrawal is taxable under certain circumstances and exempt under certain circumstances.

Refer table below to detailed understanding:

9. Process for withdrawal of EPF

EPF withdrawal can be done:

1. Either by following manual process

2. Or by filing online application

Manual Process

Withdrawal of EPF has become simpler and less time consuming if you have aadhaar number with you.

Following will make you understand the process for withdrawal of EPF with and without aadhaar.

Withdrawal of Provident Fund using Aadhaar card number:

You can submit a composite claim form (Aadhaar) https://www. epfindia.gov.in /site_docs /PDFs/ Downloads_ PDFs/Form _CCF_aadhar.pdf directly to the concerned EPFO office without attestation of claim by the employers. The payment of PF balance will be sent to your bank account, so attach a cancelled cheque along with the form.

Withdrawal of Provident Fund via Non – Aadhaar Card Number:

if you don’t have an Aadhaar, but have the PF number, use this form – Composite Claim Form (Non- Aadhaar). https:// www. epfindia.gov.in/ site_docs/PDFs/Downloads_PDFs/Form_CCF_nonaadhar.pdf

You will have to furnish Permanent Account Number (PAN) if the total service period is less than five years and also attach two copies of Form 15G/15H, if applicable. In case the Universal Account Number (UAN) is not available, you can mention only the PF account number.

Online Application

EPFO has recently come up with online facility of withdrawal of EPF, the pre-requisite to apply for withdrawal of EPF online through EPF portal is that your UAN should be activated and UAN should be linked with Aadhaar, PAN and bank details along with the IFSC code

Following Steps needs to be followed:

1. Visit EPFO portal and select services for employee from “Our Service” portal. Fill in all the login details.

2. Then, click on the tab ‘Manage’ and select KYC to check whether your KYC details such as Aadhaar, PAN and bank details are correct and verified or not.

3. After the KYC details are verified, go to the tab Online Services’ and select the option ‘Claim’ from the drop-down menu.

4. The ‘Claim’ screen will display the member details, KYC details and other service details. Click on the tab ‘Proceed for Online Claim’ to submit your claim form.

5. In the claim form, select the claim you require i.e. full EPF Settlement, EPF Part withdrawal (loan/advance) or pension withdrawal, under the tab ‘I Want to Apply for’. If the member is not eligible for any of the services like PF withdrawal or pension withdrawal, due to the service criteria, then that option will not be shown in the drop-down menu.