MSME stands for Micro, Small, and Medium Enterprises. In accordance with the Micro, Small, and Medium Enterprises Development (MSMED) Act in 2006, the enterprises are classified into two divisions. Manufacturing enterprises – engaged in the manufacturing or production of goods in any industry and Service Providers. For these small-scale industries, it is essential to make them grow with the growing economy, therefore there are various schemes introduced and implemented by the Government, divided into two categories, generic and specific listed hereunder.

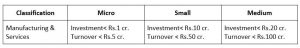

The government has recently revised the definition & recognition criteria of MSME:

Existing MSME classification

Criteria: Investment in Plant & Machinery or Equipment

Revised MSME Classification

Composite Criteria: Investment and Annual Turnover

MSME Registration Procedure:

One can register as Micro, Small or Medium Enterprise under the MSME, Act 2006 on the website of https://udyogaadhaar.gov.in/UA/UAM_Registration.aspx

Who can register?

Any manufacturer or service provider running its business in any for viz. Proprietorship, partnership, company etc. can register under MSME, if they fall under the recognition criteria

Why to register?

Government has time & again extended various benefits to business registered as MSME. We will look at the latest schemes introduced by the government in the wake of COVID-19 lockdown and other benefits & schemes which were extended & available to MSMEs.

A. Latest schemes introduced under Atma Nirbhar Bharat Abhiyaan

#1. Collateral-free Automatic Loans for Businesses, including MSMEs

All the businesses and MSMEs have been hit due to the COVID-19 outbreak and it requires funding to meet operational liabilities built up, buy raw material, and restart the business.

- Emergency Credit Line is provided to Businesses/MSMEs from Banks and NBFCs up to 20% of entire outstanding credit as on 29.2.202.

~ the borrowers having Rs. 25 crore outsourcing and Rs. 100 crore turnover is eligible.

~ loan to have a 4 -year tenor with 12 months of temporary stopping the principal amount.

~ Interest will be capped

~ The guarantee will be provided to banks and NBFCs on the principal.

~ The scheme can be availed till 30th October 2020.

#2. A subordinate debt of Rs. 20,000 crores

- MSME needs support, and therefore, Rs 20,000 crore will be provided as subordinate debt.

- The functioning MSME which is either NPA or stressed is eligible.

- Promoters of the MSME will be given debt by banks, which will then be infused by the promoter as equity in the Unit.

#3. Global tenders to be disallowed up to Rs. 200 crores

- Due to unfair competition faced by the Indian companies from foreign companies, Global tenders will be disallowed in Government procurement tenders upto Rs 200 crores.

- This will be a step towards Self-Reliant India and support Make in India

B. Other benefits and schemes available to registered MSMEs

I. Other Benefits

#1. 50% subsidy on Patent & Trademark registration:

Enterprises that have MSME Registration Certificate can avail 50% subsidy on patent & trademark registration fee.

#2. Protection against delayed payments:

MSMEs are protected against delayed & default in payments. The buyer who has procured goods or services from a MSEM, has to make payment to a MSME seller within the time period as agreed between them, which in no case, shall exceed 45 days from the date of acceptance of goods or services

In case of failure by the buyer to make payment on time, one has to pay compound interest with monthly rest at three time of bank rate on the due amount to the seller.

Government has also launched MSME Samadhan portal where a registered MSME can lodge/file a complaint against the defaulter, which after examining the case filed by MSE unit will issue directions to the buyer unit for payment of due amount along with interest

#3. Reimbursement of ISO Certification charges:

Enterprises that have MSME Registration Certificate can claim reimbursement of charges incurred for acquisition of of ISO-9000/ISO-14001/HACCP certification to the extent of 75% of expenditure, subject to a maximum of Rs.75,000.

#4. Trade receivable discounting through TReDS:

TReDS is an electronic platform for facilitating the financing / discounting of trade receivables of (MSMEs) through multiple financiers. These receivables can be due from corporates and other buyers, including Government Departments and Public Sector Undertakings (PSUs).

Here’s where you could read FAQ on TreDS: https://m.rbi.org.in/Scripts/FAQView.aspx?Id=132

II. Other schemes

Performance and Credit Rating Scheme

With the growing opportunities and challenges to the Small Scale Industries (SSI) in India, it is a need to create awareness for such industries, making them aware of the strengths and weaknesses of their existing operations and providing them with an opportunity to enhance their organizational strengths.

Therefore, the Rating scheme is introduced for the SSI sector to increase its current operations by enhancing their productivity. It will help them get good ratings which will enhance their applicability in the market, helping them in getting quicker and cheaper rates thus economizing their cost of credit.

Credit Guarantee Trust Fund for Micro & Small Enterprises (CGTMSE)

This scheme is launched by the government of India to provide collateral-free credit to the Micro and Small enterprise sector. The scheme is both fund and non-fund based, giving credit facilities up to Rs 200 Lakh per eligible borrower.

Interest Subsidy Eligibility Certificate (ISEC)

This Interest Subsidy Eligibility Certificate (ISEC) Scheme was launched as it is important in funding the Khadi program undertaken by the khadi institution. This was introduced to mobilize funds from banking institutions for filling the gap between the actual requirement of the fund and the availability of funds from the budgetary source.

Market Promotion & Development Scheme (MPDA)

The Marketing Promotion and Development Assistance Scheme for the khadi and village industry was implemented by The Ministry of MSME. It focuses on the marketing and promotional activities of the MSME sector of the khadi industry. Further, the Marketing Development Assistance (MDA) scheme has undergone few alignments to form the scheme. This scheme will provide aid in infrastructural development of the Khadi and Village Industry units.

Revamped Scheme Of Fund for Regeneration Of Traditional Industries (SFURTI)

This scheme has objectives to organize the traditional industries and artisans into clusters to make them competitive and provide support for their long term sustainability, sustained employment, to enhance the marketability of products of such clusters, to equip traditional artisans of the associated clusters with the improved skills, to make provision for common facilities and improved tools and equipment for artisans, to strengthen the cluster governance systems with the active participation of the stakeholders, and to build up innovated and traditional skills, improved technologies, advanced processes, market intelligence and new models of public-private partnerships, so as to gradually replicate similar models of cluster-based regenerated traditional industries

Financial Support to MSMEs in ZED Certification Scheme

This scheme imagines the promotion of Zero Defect and Zero Effect (ZED) manufacturing amongst MSMEs and ZED Assessment for their certification to develop an Ecosystem for Zero Defect Manufacturing in MSMEs. It also helps to promote the adaptation of Quality tools/systems and Energy Efficient Manufacturing, enabling MSMEs for the manufacturing of quality products. The scheme also encourages MSMEs to constantly upgrade their quality standards in products and processes. The main aim stands to Support the ‘Make in India’ campaign and develop professionals in the area of ZED manufacturing and certification.

A Scheme for Promoting Innovation, Rural Industry & Entrepreneurship (ASPIRE)

ASPIRE was launched to set up a network of technology centers and to set up incubation centers to accelerate entrepreneurship and also to promote startups for innovation in agro-industry. The main objective of the scheme stands to create new jobs and reduce unemployment by promoting entrepreneurship culture in India. It also helps in Grassroots economic development at the district level and also facilitates an innovative business solution for unmet social needs

Marketing Support/Assistance to MSMEs (Bar Code)

Under this scheme, the Ministry conducts seminars and reimburses registration fees for barcoding in order to encourage MSEs to use bar-codes. The basic objective of this scheme is to enhance the Marketing competitiveness of Micro and Small Enterprises (MSEs) by providing 75% off the one-time registration fee and annual recurring fee (for the first three years) paid by MSEs to GS1 India.

Lean Manufacturing Competitiveness for MSMEs (LMCS)

Under this Scheme, MSMEs are being assisted in reducing their manufacturing costs, through proper personnel management, better space utilization, scientific inventory management, improved processed flows, reduced engineering time, and so on. LMCS also helps in bringing development in the quality of products and lowers costs, which are essential for competing in national and international markets. The larger enterprises in India have been adopting LMCS to remain competitive, but MSMEs have generally stayed away from such Programmes as they are not fully aware of the benefits. Besides these issues, experienced and effective Lean Manufacturing Counsellors or Consultants are not easily available and are expensive to engage and hence most MSMEs are unable to afford LMCS.

Export Market Promotion

Export Market Promotion Scheme (EMP) is a Central Government Scheme implemented by the Government of India through the Coir Board. This scheme aims to improve the export performance of the Indian Coir Industry. In this article, we look at the Export Market Promotion Scheme in detail. The EMP scheme is applicable to the following entities: Manufacturers, Entrepreneurs, and Exporters of Coir.

Specific Schemes

The specific schemes under for MSME enterprises are for the benefit of particular entities, to make them grow and provide support in a particular direction. A few of the specific schemes for MSME enterprise are listed under:

- Science and Technology Scheme

- Coir Udyami Yojana (CUY)

- Coir Vikas Yojana (CVY)

- Skill Upgradation & Mahila Coir Yojana (MCY)

- Development Of Production Infrastructure (DPI)

- Domestic Market Promotion Scheme

- Export Market Promotion

- Trade and Industry Related Functional Support Services (TIRFSS)

- Credit Linked Capital Subsidy for Technology Upgradation

- Design Clinic for Design Expertise to MSMEs

- Technology and Quality Upgradation Support to MSMEs

- Entrepreneurial and Managerial Development of SMEs through Incubators

One thought on “Why & How to register under MSME”